New Structure for Public Education

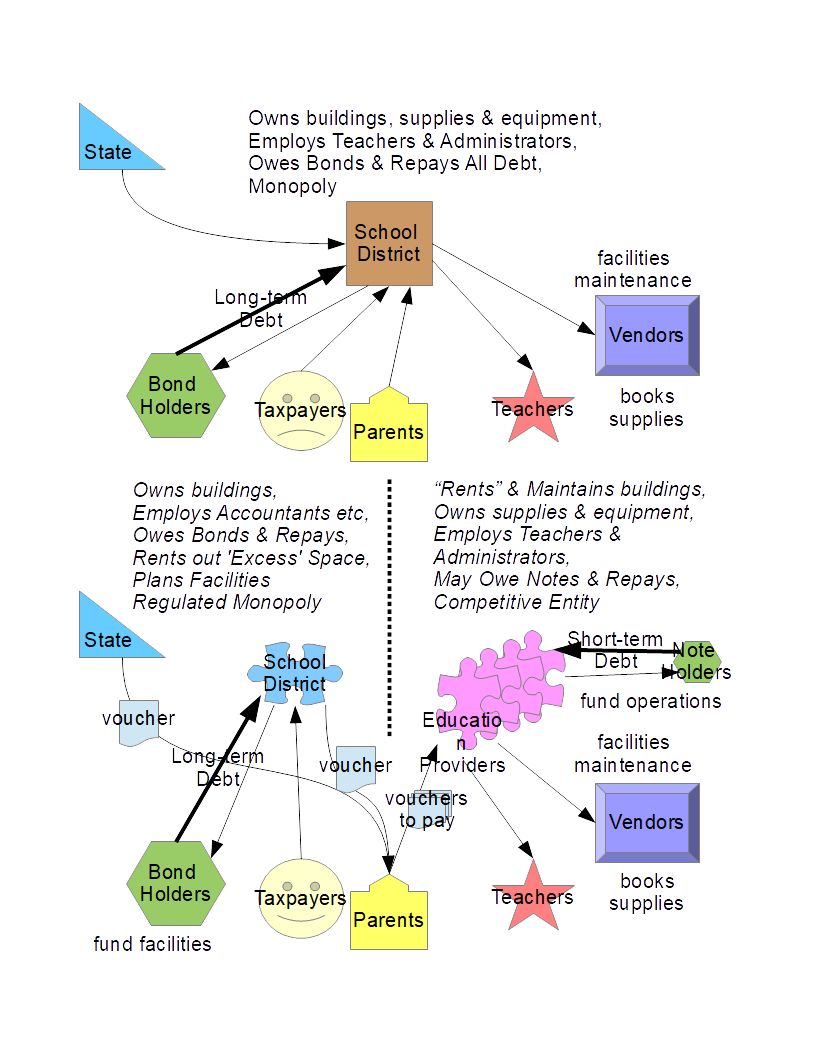

In this proposed re-structuring of public education the current school district concept is divided into:

-

Public School Infrastructure (school district)

-

Public Education Provider Organizations

In this proposal the State underwrites education, but local boards run assets, meaning the infrastructure, the buildings and grounds and other capital assets. Local boards maintain those assets from provider funds.

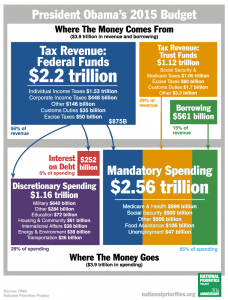

Education is paid for by local users of education primarily, but assisted by the state, by local residents and businesses and by other interested parties who may want to fund special curricula.

Power To Choose

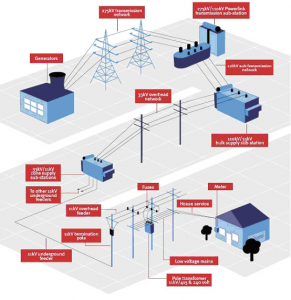

Like competition in electrical supply to consumers, where the electrical generation and transmission to consumers is separated from the poles and wires of the electric grid, and competition is among electrical providers for consumers over a common infrastructure, educational competition is among teaching (educational) providers in the delivery of education to the student. Education providers compete for students to learn using the provider’s curriculum at the exact same location as all other providers. The school is still the school (and owned by the school district), but educational providers offer their learning programs inside the same infrastructure of buildings. Visit www.PowerToChoose.org to see competition in action.

Learning may be targeted at any age group, including mature adults, retirees, working people, high school graduates, middle-school aged teenagers, children and so on, on a variety of subjects and curricula.

Some education providers may have a laptop, desktop or tablet computer for each child and various other sophisticated technology, while other providers may rely solely on written materials and teaching on the traditional blackboard. They compete right next to each other in adjacent classrooms owned by the school district. The better methods and teachers win.

Generation, Distribution, Consumption

In electric competition, generators supply electricity on a synchronized basis to the grid over transmission infrastructure to the distribution grids that take the electricity down to levels that consumers can accept the electricity into their homes for use. Final electricity providers also supply other services to consumers to enhance their product offering, like hourly readings, time-of-day rates and so on.

Competition for consumers is available over the common distribution grid (poles & wires) and allows a consumer to select a provider of electricity to generate power, deliver it over the distribution grid, measure usage at the smart meter at the drop from the distribution grid to the consumer’s premises.

Competition for consumers is available over the common distribution grid (poles & wires) and allows a consumer to select a provider of electricity to generate power, deliver it over the distribution grid, measure usage at the smart meter at the drop from the distribution grid to the consumer’s premises.

Generators (providers) operate off natural gas, diesel, nuclear, wind, solar and other raw energy sources to make electricity by companies like TXU, Reliant, and so on.

Poles & Wires (the distribution grid) are owned by Oncor, for example, and regulated by law.

Consumers decide what energy source mix they want to use and what price looks best for them. The pricing includes a charge for pass-through by the distribution grid (Poles & Wires) owner(s).

Students: Consumers, Schools: Poles & Wires, Providers: Generators

Similarly, in education the State supplies core educational goals and materials for a large chunk of the educational curriculum, that can be used for that purpose in a state-wide transmission-shipping network. Providers bring their own or state materials for all optional, supplemental or enhanced education. School districts supply buildings and infrastructure, and supply utilities and common services on a shared basis to all education providers in its buildings.

De-regulated education is enabled by dividing regulated educational institutions, which are buildings and other facilities funded and paid for by taxpayers that do not offer education itself from de-regulated education providers, who can bring their own methodologies, equipment, materials and personnel to provide education to the public. Providers divide their offerings by age group and subject matter and must meet educational goals and other standards set by the state if any.

Taxpayers are guaranteed not to have to pay more than 20 years on any facility the regulated school district entity builds, and education providers fund the maintenance of those same facilities through their fees.

Educational providers collect fees from students, donations from local businesses and organizations, vouchers from parents supplied by state and district, if available, and other sources, like PTA’s and volunteer groups. Some education providers will have all-volunteer staff or some mixture of paid and volunteer. We should let the local market and culture decide.

ERCOT and Facilities Planning for Education

Electric Reliability Council of Texas (ERCOT) studies population movements, consumption, and economic trends to recommend changes to electrical suppliers and the Texas grid.

Any time the schools entity projects that capacity is insufficient to meet the needs of the community they can float a proposal to the taxpayers to modify or add on to existing facilities to provide a specified capacity that supports specified capabilities at a specified cost and estimated time to pay back the cost within 20 years. School planners can also propose multi-million dollar facilities to be shared across the whole district or wider, even.

The days of a handful of elected board members deciding to obligate taxpayers to tens of millions in future taxes to pay for a stadium that threatens to collapse a couple of years later needs to end, and end abruptly. No more indenturing future property owners with massive debt without an approval vote.

Using a ballot referendum revealing projected need, capacity and cost information, taxpayers can reject a proposal offered or can approve it to design and build additional facilities. When more than one option is available, the school district may present a choice of options to the voters or a straight up-or-down vote on the option it considers best. But we should be wary of take-it or leave-it and advisory votes.

Note that the buildings may need to accommodate a variety of body sizes in the toilets and other facilities, and that security may be a tricky subject to tackle. Age groups are often not mixed in traditional schools, although they may have been in the 19th century. It is not clear why age groups were segregated, except that security of younger students may be an issue.

Any time the school district projects that excess capacity exists or will exist, it may conduct a referendum to dispose of a facility and return the proceeds to the taxpayers after all debt is paid off.

Incumbents and Capital Accounts

A regulated school district may also be an educational provider if it so desires through a separate provider entity. A school educational provider entity must compete fairly with other providers and cannot undercharge or overcharge for its students. All providers who qualify are afforded the opportunity to use the regulated school district facilities by paying the appropriate operating costs and maintenance proportionate to its use.

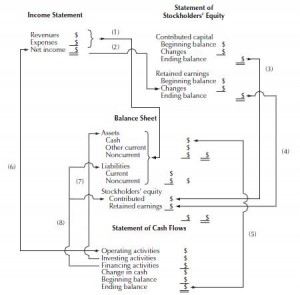

Who pays what is important in this re-structuring of education. Taxpayers have been on the hook for both paying for buildings (now to be owned by the district) and teaching (now done by a separate education provider).

Initially, nothing should change, because re-organizing staff and finances is traumatic. As when TXU split into Oncor and TXU Electric, school districts need to split into School District and Education Provider. Their finances must be kept separated. Local taxes fund the amortization of school district bonds. All taxpayers in effect become stockholders in the school district. CoServ divided its capital assets and created funding for the infrastructure side of its business that consumers effectively owned. As “profit” accumulated each year, CoServ paid its consumers in proportion to their accumulated billing payments.

The school district will be paying down its debt over time, amortizing the amount borrowed, resulting in equity building up in the value of the facilities. Buildings are maintained by provider funding, keeping them fungible at a stable or increasing value. If a “profit” or return of equity situation occurs, those that paid in will be paid back. Return of capital can occur if a building is sold, for example.

Reduced Payback Period for Bonds

It is important that all bonds and borrowings issued are not of terms exceeding 20 or so years and voters get to approve of all bonds. No taxpayer can be expected to pay for his whole life with no prospect of relief. A family may buy a new house in a subdivision that just voted to add a school in a bond election, and after it’s built send their children to that building. But after 14 years or so, the family no longer needs the school, unless they have more children in their home. So, the fairness of paying for a building that they can make little use of comes to the front. Bonds should never be used for short-term assets.

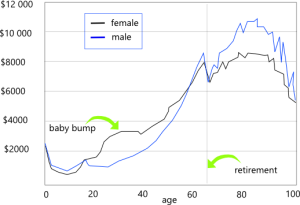

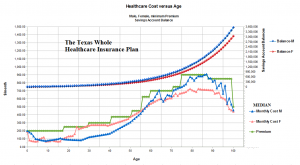

If a building is put up using bond money and the bond is paid off after 20 years, then what is the taxpayer sending money to the school district for? The portion of taxes for paying off the bonds should end after a reasonable time. A family may finish sending its children to school after 20-30 years. We can plan on reducing the taxpayer’s load significantly after they have paid for at least 20 years and finished sending their children through the educational system. Typically, this 20-30 years coincides with normal retirement age, although it may occur later or earlier than 65.

The difference in monthly payments of a 40-year bond and a 30 is about 14%, while a 30 vs a 20 is 27% or 19% for 22. Shorter payback periods result in slightly or somewhat higher payments but massive savings.

Taxpayers need to be relieved of taxes to pay back bonds eventually if they have no school-aged children in the system and have already paid for decades. Education is not provided by the buildings themselves.

As to the educational portion of schools, not the infrastructure, a transition from paying a single amount to the school district to splitting the payment into district infrastructure and education provider payments is needed. Right now the state sends funds for education, but it is at least partially used to pay off debt for infrastructure. That funding of debt needs to end.

The state should continue paying a portion of education, and as part of the transition, vouchers should be issued to every registered family with a school-aged child.

Voucher Eligibility and Issuance

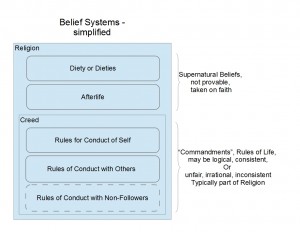

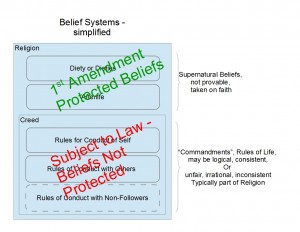

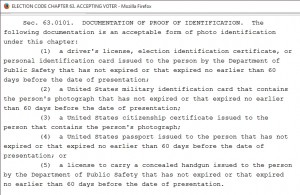

To register to receive vouchers a family or a guardian must apply to the state via the district where resident. Only citizens may apply or other lawful residents, such as military personnel posted in the district or lawful immigrants. The state must establish who is eligible, including how long a person must reside in the district or lawful exceptions, such as transfers from other eligible districts. The definition of citizenship and resident must be spelled out in the law to prevent arguments and possible judicial cases.

Initially, the vouchers can be used only for any captive (incumbent) school district educational provider to get people accustomed to paying that way. Over time, new non-incumbent, challenger providers will appear and vouchers can be used to fund those providers in the same school district facilities or to fund the incumbent provider.

Of course, the old school district needs to release parents from the obligation to use the school district’s incumbent provider. Basically, a parent can choose to use the voucher at any educational provider that meets state standards, including home-based education. We can expect chartered non-profit, profit, incumbent government (non-profit) education providers, all meeting state standards.

At the same time, the local taxing authority also collects taxes that in part fund educational providers. So, a second voucher will be issued by the local taxing authority for the education portion. Parents will initially be able to use the second local voucher only at the incumbent provider. After a transitional period, the second voucher will also be usable with other providers, including home-based schooling.

Transition

It will take some time for educational providers to plan for the next academic year and can do so after knowing the estimates of voucher amounts, market demand for their planned services at anticipated price levels, costs of providing labor and materials for their offerings

Hopefully by the time both vouchers are usable with alternative providers there will actually be other educational providers. We should expect some degree of disruption in the whole process as providers come on-line, compete and some fail. Failure is just part of competition. Right now we have major failures in some school districts, and they need to change. Some school districts are currently successful, and they will more than just survive competition, primarily because parents will elect to remain with successful incumbents.

Home schooling, alternative, charter and remote learning are all options that will flourish under a competitive system. As education transitions out of brick-and-mortar based school districts to more 21st century methodologies other learning approaches will become prevalent. Education will no longer be confined to K-12 and college. Costs are expected to drop significantly and choices grow exponentially.

Perhaps the state can enable the process of transition for every district, but allow parents to opt out of competition as a family decision initially. A transition period that lasts longer than the depreciation period of school-owned short-term assets would be unnecessarily long. Parents would, effectively, receive the state vouchers and district vouchers (and be notified), but they would be paid directly to the educational provider. Later, they should be able to join in competition, if they so desire, and actually receive the vouchers in hard form. Some districts will embrace competition readily and lead the way, while competition will effectively dismantle district schools that under-perform.

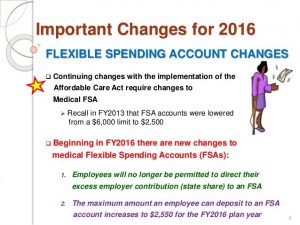

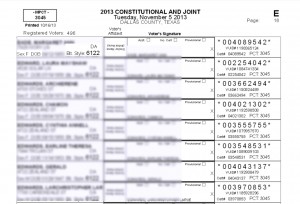

Security for vouchers would be a concern so as to prevent forgery and duplication. Electronic distribution should be enabled but secure. The Secretary of State can set up a Public Key Infrastructure (PKI) to facilitate secure delivery, receipt and accounting for vouchers, as well as other matters. Once signed over by the student’s guardian/parent, a voucher is redeemed by the provider from the issuing entity (state or district) and may be supplemented by the student’s guardian.

Splitting Short-term and Long-term Items

Currently, school districts have both short-term and long-term assets and liabilities. The objective is to separate the short-term items to the incumbent education provider and the long-term to the school district. As the short-term liabilities are paid off and assets, like books and computers, are depreciated off the books, the incumbents will be in the same position as competitive providers. The short-term debt is actually owed to the school district when separated. Competitive providers will owe their working capital or short-term debt to outside lenders. Of course, providers can negotiate sharing deals for short-term assets or buy and sell them. The school district should not be involved in these dealings.

Notably, some items in a school building are not short-term assets, but more correctly classified as fixtures in real property. Some examples in the school are toilets, drinking fountains, cafeteria fixtures, like stoves, ovens, counters and so on. In commercial real estate fixtures are the property of the renting tenants, not the property owner or landlord, but in some situations landlords provide Common Area Maintenance (CAM) for lobbies and property fixtures or common area utilities.

This concept can be carried forward into the new restructuring of school finance by allowing school districts to provide some common facilities to all or some providers and charge accordingly. This is not to be used as an excuse not to restructure assets and care must be taken by state authorities to review and approve all such proposed arrangements, especially if a competitive provider complains of unfairness in providing such facilities or the charges. The state by law should provide guidance as to what is appropriate to include in CAM and what not to, such as sanitary bathrooms or water fountains or even a library, a swimming pool, a weight room and the like, and to publish statewide statistics for comparison.

The Way Forward

The first step was accomplished long ago, separating I&S from M&O. Now to complete this step, all assets, charges and payments need to be reviewed to assure they are properly classified.

- Freeze all bond issues, limiting issuance to compliant plans to sell bonds

- Publish accounting standards and qualifying guidelines for districts and providers to use and rules for state audit of public educational entities, districts

- Negotiate a timeline with cognizant agencies for transition, specifying goals for each step

- Establish a PKI at the Secretary of State for state-wide use, set up officials

- Receive and review each district’s plan for transition

- Set timeline for beginning and ending transition, including elections if any

- Set up procedures for student voucher applications and registration

- State budgets per-voucher amounts by district prior to district budgeting

- Districts budgets local voucher amount plus sets I&S amount for tax purposes

- Incumbents budget student M&O amount for tax purposes

- Qualified competitive educational entities publish pricing to attend by district

- Families make choices, all providers finalize class sizes , curricula, etc

- Vouchers tendered and paid periodically, specifying procedures for changes