Health Savings accounts that belong to employees to pay for healthcare insurance negotiated with employers is a better solution than one-size-fits-all Federally-forced insurance.

Health Savings accounts that belong to employees to pay for healthcare insurance negotiated with employers is a better solution than one-size-fits-all Federally-forced insurance.

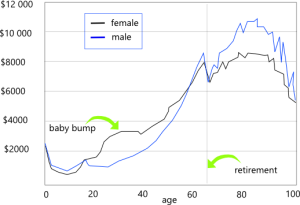

Healthcare costs are low when young, but a person should be able to save up while covered using a HSA they own and control. Insureds should be able to decide what coverage they want at what time in life. The graphic from nearlyscience.com illustrates the costs over a lifetime for men and women.

Of course insurance companies exist for profit, but terminating insurance because the company had to pay out is just wrong. Maybe they could re-rate an insured, but dropping people should be outlawed as a violation of the insurance contract. Naturally, we have to protect insurers from fraud and hiding the truth by insureds, but refusing to pay a claim is equally wrong.

Promised Reforms

When Obama ran for office we all thought his “reform” of healthcare insurance involved having insurance companies:

- Pay claims in a timely fashion

- Pay the whole claim and not pick & choose

- Maintain coverage (no-drop, no-cancel policies)

- Provide more choices of coverages, like including optical & dental

We didn’t get that. We got a massive Federal takeover of healthcare via massive regulation of healthcare insurance and new taxes. Small businesses with only 50 employees would be required to hire a non-producing insurance administrator (or contract out the work) to comply with new Federal regulations. This is an absurd burden on small business. How do you hide a 2% increase in labor costs?

Worse, the “new” insurance includes all sorts of ‘gimmes’ like free mammograms for both sexes, free pregnancy, free birth control and abortions, and so on. Free or included is irrelevant, since the insurer has to account for the included costs in their premiums, making them higher. And employees and employers right to choose was curtailed, especially painful was violation of matters of conscience and religion. The promised savings of $2,500 per family did not appear and have no chance of happening.

What’s Wrong

Fine, refusing to rate someone (accept them into the insurance system) is wrong. We need to accept all applicants, but it is only fair to charge them according to risk. This is especially true for matters that insureds have control over, like smoking and obesity or other choice of lifestyle and choice of risky behaviors.

Currently, “standard” versus “preferred” versus “substandard” are insufficient to classify risks of potential insureds. But this is an industry choice, not a government matter to regulate. “Poor” risk insureds should still be accepted with their own rating below substandard, but allowing someone to get protection once they have detected a medical condition and be accepted without paying extra is wrong.

Perhaps the contract should require a waiting period, which was common under old regulation, or perhaps the contract should require the insured to remain paying as a customer for a certain period of time in order to recoup its upfront losses.

Universal Life Insurance

A parallel policy called “Whole Life” insurance is instructive. Actuaries rate individuals and the company collects a monthly premium that will pay a certain amount in event of death of the insured, but the insured can actually add in extra money every month to accumulate at some specified rate. The rate can be fixed or variable according to some index, like stock market pricing. But over a period of decades the accumulated extra amount grows Federal tax-free.

If the insured does not die, then the accumulation is payable to the insured. Some contracts allow the accumulation to be set up as a source of payment for the insurance policy itself. Sometimes this is called a Modified Endowment Contract. But the upshot is that the insurance coverage with a specified death benefit is paid each year by the earnings from the accumulation in the savings account. The insured can also borrow against the policy value before the final payout.

“Whole Healthcare” Insurance

Why don’t insurance companies offer a “Whole Healthcare” insurance policy, similar in structure to the Whole Life policy but geared toward healthcare and with a similar accumulation account?

The accumulation can be Federal tax-free and grow over a lifetime until needed for hospice care, eldercare, or the expected massive costs at end of life. During other times the accumulation could be used to meet deductible, if the insured so chose, or to pay for non-covered medical expenses. While these uses would reduce the accumulation and could result in shortfall decades later, they should be allowed tax-free. Clearly, insureds should be advised to borrow the funds and pay them back and advise the insured of the potential consequences later in life.

Forced Compassion by Government

Almost all of us have compassion for people who cannot afford to pay for healthcare procedures, but government is so bad at doing anything involving money, we simply cannot afford government-run compassion. No subsidies for some people and not others. No special credits via income taxes. Let those of us who choose to help others with their expenses do so on a case-by-case basis, allowing us to judge how much we will give compassionately and who is worthy.

States need to unfetter the insurance industry to find solutions. Feds need to get out of the way.