You Don’t Need an MBA

So many people are afraid to try to figure out their own spending habits and make a budget. Young people don’t want to be restricted and never had the practice handling money to understand what “budget” actually means.

Before turning to government budgeting, let’s look at family budgeting. Whether you’re a single person living in an apartment or a multi-generational family living in a huge house, in order to avoid problems like calls from collection agencies or being evicted for non-payment you have to plan your monthly and annual spending so that at least you don’t run out and maybe you actually save some money.

Income vs. Outgo

Usually people try to figure it out the hard way – run out of cash or max out their credit cards, and then plan what they should have done instead. Maybe they can dig out at that point, maybe not.

Look at your paystubs. You earn so much every pay period, but there are deductions before you even see the paycheck. Mostly they’re taxes, but also things you have some control over, like insurance and retirement contributions. You might also have some other income from a stock account your parents gave you or you created yourself.

Look at your bills. Food, housing, car, auto insurance, entertainment, cellphone, electricity – the list is long. Most of the bills are monthly but some are daily or annually, and some are one-off, like buying a stereo for your living room.

You know that over the course of a year that total paychecks must not exceed total bills, plus you’d like to save a little for your retirement fund, or an emergency fund. When you’re first starting out in life, that can be really hard to do, even to balance the paychecks with the expenses. The tiniest emergency expense can deplete your meager savings and send you into a cycle of paying late on every single bill.

You have to have a balanced budget for your family finances

Unless you can literally tighten your belt by not eating as much, it may take a while to recover. If by some magic you have a credit account, you can load it up and then suffer just a little belt-tightening each month to pay back the borrowing.

Expenses, Assets, etc.

It may make sense to borrow money to buy a car. The car is a long-term asset and so an installment payment plan can also make sense. If the car will last 5 years, a loan for 5 years seems acceptable, but a 10-year loan would not be sensible. Why be paying for some asset that is no longer useful? Pay it off over its life or earlier, if possible.

What is really irrational is borrowing money to pay for daily expenses. Getting a car loan may be rational, but paying for last week’s groceries over 18 months is not. You should reduce your food expense to match your funds available for food, or else you will build up a sizable debt just for eating every day.

Your available funds for spending will shrink as you take on more loans to be repaid. This is the real meaning of budgeting. Yes, you can borrow, but eventually you have to pay it back, and you should only borrow to purchase assets that have a useful life – not something perishable or quickly consumed.

Businesses are like Families

Businesses (because they’re run by people who budget their own family finances) learn early on in their existence to bring in more money than they spend – the leftover is “margin” not mad money. Margin must be dedicated to retained earnings, rolled over and set aside to pay for growth, improvements in equipment and paying stockholders and, yes, taxes on business income (note other taxes are expenses before margin).

When a business plans their budget, they must include their expenses of production or for services on a daily or unit basis, plus include the monthly lease, annual business insurance and the like. This is just like what families do. They have accumulate money to pay annual or quarterly bills in addition to paying the invoices that come on a monthly basis.

Master of Business Administration (MBA)

In business school MBAs learn to plan Cash Flow, one of the basic 4 accounting statements. When cash runs out, bills can’t be paid – so running out of cash is a crucial aspect of budgeting. A Cash Flow statement attempts to predict how much cash will flow in from Sales and how much will be needed to pay all the Expenses, both of these are normally done on a monthly basis looking forward 1 to 3 years.

In MBA school we learn that when cash is negative for one or more months, a loan must be taken out to cover the shortfall. If an asset is to be acquired and that “caused” the shortfall, then a bond could be sold to cover the gap. The bond has quarterly payments that cover the interest and eventually the whole face value of the bond (principal) must be paid off.

The quarterly payments are tacked onto the monthly “expenses” to re-calculate Cash Flow. Maintenance on the asset is also added to the list of expenses for Cash Flow calculation. A non-cash expense is the depreciation of the asset. The term of the bond is never longer than the useful life asset purchased.

Basic Accounting Statements

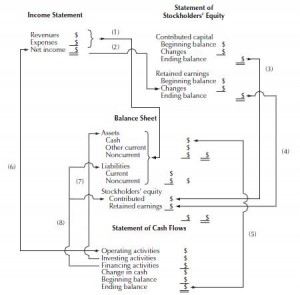

Cash Flow analysis is crucial to balancing a business budget. In addition to Cash Flow, a business has a Balance Sheet, which tracks Assets, Liabilities and resulting Net Worth. Liabilities are forward-looking obligations that must be paid. In the Cash Flow statement we must enter the monthly repayments and payments, but the total borrowing or other amounts the business owes are liabilities on the Balance Sheet, like the face amount of the bonds issued to borrow money.

When we subtract the Liabilities from the Assets, we know what the business is worth. This is what the Balance Sheet shows owners and shareholders. All of the Margin from Sales less Expenses is shown in the Income Statement.

The Income Statement feeds the cash into the Cash Flow statement where Depreciation increases cash and the result flows back into the Balance Sheet.

A Budget is just the planned figures that managers plug into each of these statements, starting with the Income Statement: Sales & Expenses. If Cash Flow analysis indicates a shortfall, borrowing can be done, but this increases liabilities and lowers Shareholder Equity.

Government Accounting Statements

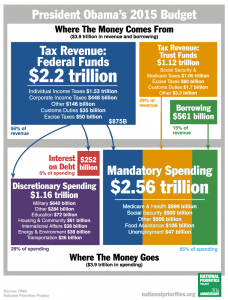

Have anyone ever seen a Balance Sheet for the United States Government? Maybe there’s one, probably not understandable, but certainly not discussed. What does the US own, what liabilities are there to be paid off in the future, and are the income and outgo flows balanced?

When the government borrows to meet shortfalls, eventually those liabilities need to be paid off. Future Cash Flow must not leave a deficit (shortfall), else Treasury must issue bonds and sell them for cash in the international market. They become liabilities on our National Balance Sheet that future generations have to pay off.

Businesses know that temporary shortfalls can be filled with Working Capital loans. Those are paid back quickly, not over 30 years. If the government operated on a biennial budget, a working capital loan would be repaid within those 2 years.

Long-term borrowing is done by business for long-term assets. The repayment terms of borrowing for a piece of equipment is always less than the useful life of the equipment. No business borrows for 20 years to pay for a luncheon. There is no such thing as “investing” in consumables or disposables. Government needs to follow the same repayment rule for loans to acquire durable assets: pay it back within the useful life of the asset.

Accounting & Budgeting

Before a budget can be constructed for the next year, last year’s figures have to be gathered. Then the changes can be compared. Changes in spending or revenues have to added to the analysis.

We first need the basic 4 statements for government before we can analyze our current situation. The Office of Management and Budget (OMB) and the Congressional Budget Office (CBO) do have figures but they are separate. You can find income tax figures, both estimated and actual, but not in an Income Statement form – they are disjoint to obscure how little income there is versus expenditures.

National Balance Sheet does not exist showing all the land Bureau of Land Management (BLM) manages or General Services Administration (GSA) owns are buildings, equipment, vehicles, furniture and so on. Never mind the assets the military possesses.

How can we manage a business as huge as the Federal Government when reports that Sarbanes-Oxley requires of all businesses aren’t even available? Worse, S-Ox requires CEOs to sign off on the veracity their financial reports, but no one swears even the Unemployment figures are accurate, much less the non-existent National Balance Sheet.

Making Big Data Understandable

No one can grasp the magnitude of the Federal government. It is, after all, $3,900,000 Million. A family household income of $50k is common – so a Million is 20 families’ households’ budgets. The Federal budget is 3.9M times 20 families’ budgets. It is nearly unfathomable.

In broad brush a normal person can understand a statement with up to about 50 or 100 items. A top-level budget would be better understood if it had items up to about $39B so that only 100 or so items appeared on it.

For management purposes those 100 entries should be further broken down in more detailed statements also consisting of around 100 items, or roughly $390M. And, in turn, those detailed breakdowns should be broken down further to chunks of $3.9M, making them less than the budget of 100 families’ household budgets.

If the most detailed breakdown had 1,000,000 line-items we would have sufficient detail to track down waste and fraud. But what about the income side?

Off-Budget vs. Budgeted Revenue

Seizures are a wonderful way to hide waste. If GSA can seize property and sell it at auction or IRS can seize assets and not have to go back to Congress to get permission to use those seized assets, how can Congress ever hope to control spending?

When TARP funds were repaid by bailed out companies, where did those funds go? Shouldn’t they have gone to reduce the deficit? They didn’t.

When the National Park Service or the Passport Agency in Immigration service collects funds, do those get deposited into the Treasury or are those funds held out as if they “belonged” to those respective departments? How can we manage a budget that doesn’t bring the revenue back to a single point, but allows independent autonomous funding or whatever self-funding the agency wants? The obvious single accounting point is the US Treasury. All funds must flow from or to Treasury – nothing hidden.

It is not necessary for all revenue to be a tax or a fee, the US Government can dispose of assets it owns or it can lease those assets out for additional revenue. A business would consider disposing of assets to fund its business plan.

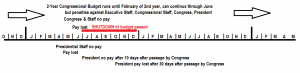

Continuing Resolutions

It doesn’t make sense to plan one year and then not have a plan for 5 years. Circumstances continually change, each Congress was elected with an agenda in mind, and their budget should reflect that election. In limited situations it may take a while to resolve budget conflicts, but not the entire term of the Congress. If Congress cannot come to terms over the budget, then only a complete shutdown will apply enough pressure to reach a resolution.

At the beginning of each term of Congress, the President needs to propose a budget based on the current situation in the government and economically. If the President refuses to do his duty to propose, then it devolves to Congress to set a budget without his proposal. However, if the President continues to fail to propose a budget, then the Executive does not need to pay for his staff, who are not performing.

When sufficient time has passed and Congress must create a budget, with or without Presidential input, they also must do their duty to pass a budget law, establishing revenue and expenditure levels that the Executive must abide by. Should the Congress itself fail to perform its duty, then like for the Executive first Congressional staff should not be paid. If Congress continues to fail to resolve its differences then Senators and Representatives should lose their compensation.

The loss of compensation can simply be a delay in payment at first, then become a permanent loss of pay. Finally, once Congress has done its duty if the President fails to enact the law passed, the President himself (and his expense account) should permanently lose his compensation until a budget law is passed and signed.

If no budget law is ever passed as was the case under Senator Harry Reid, nothing should be paid out of Treasury at all, whatsoever. If a family could decide how to budget its money, they should just stop spending until they do decide. The same for government.